When I launched my semiconductor company, I was betting my family’s entire future on a widely cyclical industry. I had 36 profitable GAAP years out of 37; the one-off year resulted in a tiny loss, and that was due to a write-down while closing a redundant fabrication facility.

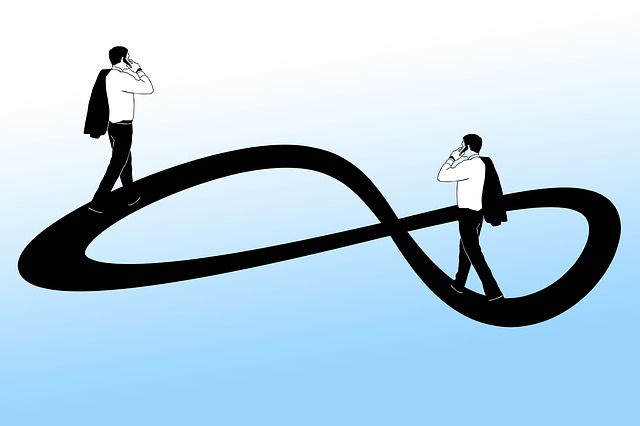

All industries face cycles. Most endure economic and business cycles. The high-tech industry faces a third, namely the undulations of tech innovation, advancement, market saturation and reinvention. Knowing and mastering these cycles leads to serial profitability.

Sine Waves of Markets and Money

National and global economies have cycles. Driven now primarily by consumer spending, revenue streams are accelerated and retarded by consumers, their incomes and their employment status. When economies enter recession, spending slows. In the high-tech arena, this translates into fewer cameras, smartphones, laptops and even corporate servers being bought (lack of consumer spending leads to reduced corporate spending). These generalized cycles last about six years, and before the Great Recession, they were somewhat predictable.

Cycles within various industries have their own calendars. Some are shorter or longer than the general economic cycle. The high-tech industry oscillates every 3–5 years, as a rule of thumb. With semiconductors, an integral part of most other tech, I was quite attuned to both the broader economic cycle and the shorter tech cycle. Like standing waves (for you physics buffs), the economic and tech cycle might simultaneously rise or fall together, which only made the semiconductor industry’s wild ride even wilder.

Many tech companies have gone bankrupt by not adequately preparing for the down cycles, and worse yet, simultaneous down trends. Just as everyone thought they were genius investors in 1999 when the market was riding high, so do many tech business leaders feel they are geniuses when they are riding a cyclic upswing. Both the dot-bomb investor and the wannabe tech titan feel quite different when the cycle heads south and the bank account reaches zero.

Product introductions, types and timing

It is important for every company to manage the down cycle and to time product releases in the appropriate phase. Those that don’t will die or struggle to grow.

With some exceptions, introducing new consumer products at the beginning of an up cycle is best. Only when consumers feel confidence in their economic future will they spend freely enough for the next new gizmo.

For tech producers further back in the value chain, this requires the uncomfortable process of developing new products during the down cycle – when cash flow is low – and promoting it to manufacturers before the economy turns around. Where so many tech companies falter is not preparing for R&D and other expenses in the down cycle. This is especially acute for startups.

“Cash is king” is a line I use daily while mentoring startups. Banking cash during up cycles – both economic and industry cycles – ensures survival as well as R&D flexibility during the down cycle. Some people think they can borrow during the down cycle, but it is always more difficult to raise cash during that phase. And there is the expense of borrowing, which discounts future revenues. Staying lean and banking cash is always the way to run a company during good times and bad. Since cycles can shift quickly, the need to stay lean and mean at all times is critical in the tech industry.

Startups and Disruptions

Startups face several interesting aspects to these cycles.

Foremost is that too few startups plan for cycles at all, and fewer still develop their second product soon enough. With tech lifespans timed to the tech industry cycles, when a startup’s first product is in a decline, and the economic and/or industry cycle takes a dive, a startup can run out of cash by not having the next new thing ready in time. Startups need a product that will last through a full industry or economic cycle to have any chance of corporate maturity. They need to last two business/tech cycles to be considered a successful company.

The timing of the cycle, as noted before, is important. The exception, though, can be if the product is truly disruptive (there are incremental, evolutionary and disruptive technologies). A disruptive technology, one that causes past solutions to be obsolete, faces long adoption periods regardless of industry or economic cycle. In theory they can be introduced at any time, and indeed for some disruptive B2B technology, introduction during a down cycle might garner extra interest from firms looking for a way to optimize their own business.

Past as Predictor

All tech companies should look into the past, to examine the cycles that their product categories, sector, industry and the general economy have taken. Though future cycles cannot be perfectly predictable, their timing will likely be similar to past events. Match the cycles with your product planning, and be sure you can power through the down side of the cycles on banked cash to explode out of the chute with enhanced or new products when the cycle reverses.

Originally published at Forbes