Tough Things First Podcast

The Tough Things First podcast is where you receive short bursts of Ray Zinn’s leadership, executive and entrepreneur’s wisdom. Tough Things First podcasts are typically five minutes long, giving you one important concept to ponder for the rest of the day.

Subscribe to the podcast via:

iTunes | Spotify | Google Podcasts | Stitcher | Pocket Casts | TuneIn | RSS

- Feb0320210

Silicon Valley History – Part III

Read moreRay Zinn, the longest serving CEO in Silicon Valley, discusses the history of silicon as only he can, having watched it from Shockley to Facebook.

In Part III, Ray and Goldman Sachs analyst Peter Marchetti cover the shifts from chips, to computers, to software.

Peter Marchetti has spent the past 20 years as an advisor to some of the most significant families and foundations in the country. He joined the Goldman Sachs team in 2000 after receiving his MBA from the Haas School of Business at the University of California, Berkeley.

Ray Zinn: Hello everyone. And welcome to another very exciting series of podcasts about the history of Silicon Valley. Everybody in the world knows about Silicon Valley, probably one of the most recognizable names in the world is Silicon Valley. In fact, I don’t tell anybody that I’m from the Bay Area. I just tell them I’m Silicon Valley because they know exactly where that is. So anyway, welcome to another of our… This is a third in our series of podcasts regarding the history of Silicon Valley. For those of you are interested in how it started and what it’s led up to and… Because we’re going to cover it all the way from the beginning, which is in 1957, to 2020. We’re going to talk about the history of the Valley for those 60 years, a little over 60 years. So again, thanks for joining us. We’re happy to have you back. And my good friend, Pete Marchetti, who is a financial advisor in the Bay Area is the host of our series. And thanks. Welcome Pete.

Peter Marchetti: Thanks again for having me Ray. Again, looking forward to another exciting podcast and continuing to learn about Silicon Valley.

Ray Zinn: Well, let’s get going. Let’s dive right into it.

Peter Marchetti: The last podcast ended with you talking about Fairchild and the environment there, how it got started, the culture, and you were beginning to talk about some of the incredible employees of Fairchild, not just the founders, but other people that were there. And, we were beginning to branch into why Fairchild was so important in really developing the semiconductor industry and making Silicon Valley what it is today. So maybe a good place to start would be to continue to talk about some of the personalities that were there, what they were like, and then maybe we can branch into some of the things that they ended up doing once they left Fairchild.

Ray Zinn: Sure. Okay. So we’re kind of up to about 1964 in the series. I mean, I’d been with Fairchild for one year and so in that one year, I can’t even tell you how much happened. I mean, it was unbelievable. The dynamics of the industry are changing so rapidly. We were struggling, and had been struggling, for the past three years in developing the first integrated circuit. So as I mentioned earlier, integrated circuit is combining multiple transistors on a single chip, meaning a single piece of silicon. So we had a group called DIC, Digital Integrated Circuits. That was the name of the department at Fairchild, and that was run by a fellow named Jack Gates. Jack is kind of a rough and tumble guy. I mean, I tell you not only is he big, he’s got a deep voice, but he’s also a violinist.

And so it was really funny to see this big guy with his big fingers and playing this violin.. He was an exceptional violinist. But he was a head of the DIC group at Fairchild. In 1964, we had developed the first integrated circuit, a flip-flop, and that was excitement. I mean, that was so exciting I can remember that Jack was standing on his desk, playing his violin, doing a kind of an Irish toe dance, celebrating as we got the first integrated circuit to work. And that was an extremely important day. I am so grateful that I am part of that history, that I could be there on the very day that first integrated circuit was turned on. I can remember that day as clear as I’m sitting here talking to you is to hear Jack doing that Irish toe dance on his desk. I thought he was going to break that desk because he was so big, as we were all singing and dancing around and just cheering when we flipped on the tester and that flip-flop worked. I mean, I’ve never seen so much excitement in my entire life. (more…)

- Jan272021

Silicon Valley History – Part II

Read moreRay Zinn, the longest serving CEO in Silicon Valley, discusses the history of silicon as only he can, having watched it from Shockley to Facebook.

In Part II, Ray and Goldman Sachs analyst Peter Marchetti cover the changes after silicon defined the tech-centric nature of the valley.

Peter Marchetti has spent the past 20 years as an advisor to some of the most significant families and foundations in the country. He joined the Goldman Sachs team in 2000 after receiving his MBA from the Haas School of Business at the University of California, Berkeley.

Ray Zinn: Hello, everyone and welcome to the Second History of Silicon Valley this is Ray Zinn, a founder and author of Tough Things First and we’re so delighted to have you join us again. As I mentioned on our previous podcast, we’re going to be discussing the history of Silicon Valley. So those of you who are interested in Silicon Valley you’re going to enjoy these podcasts. Thanks for joining us and this is our second in our series of the podcast. If you missed our first one, you can go to our website, toughthingsfirst.com and pick it up and we would suggest you start from the beginning. So if you’re a newcomer to this series, please go back and then listen to them all in sequence otherwise it’ll be a little confusing. I have my good friend financial advisor, Pete Marchetti, who is joining us today as our moderator for Tough Things First, Silicon Valley history series. And so welcome again, Pete so happy to have you.

Peter Marchetti: Thanks again for having me, Ray, I’m looking forward to continuing our series of talks.

Ray Zinn: Where we left off was I started in 1963, I had left the United Technology and joined this new fledgling six year old company called Fairchild Camera and Instrument in Mountain View, California.

Peter Marchetti: Yeah. Thanks Ray. Well, last podcast ended with you talking about how you became aware of Fairchild from your father-in-law and he kind of sold you on the idea of working at the company and you go there and I guess, it would be great to hear a little bit about what Fairchild represented back then, because I think and nowadays we all talk about other semiconductor companies, but not as much about Fairchild. It had a kind of out-sized importance in terms of the development of Silicon Valley and what it meant for the evolution of the area in the industry. And so could you talk a little bit about like where Fairchild was at that time and how important it was and maybe a little bit about how it began?

Ray Zinn: Dr. Shockley left Bell Labs and he had a group of scientists, people that he brought with him to the Bay Area and primarily in the Palo Alto area. And again, just to rehash, Dr. Shockley is from Bell Labs in I think Pennsylvania where they were again, developing very high tech processors. And so there was a group of men, they were called the traitorous eight split away from Shockley and formed Fairchild. And Pete’s going to have to help me remember all these people’s names because he has that list in front of him. But there was Dr. Robert Noyce who ultimately, who was the CEO and President of Fairchild.

So what just to kind of a quick rehash on that, Fairchild Camera and Instrument was a company back in Maine, I think, or somewhere around there and they made cameras and other kinds of instrumentation. And so that name, Fairchild Camera and Instrument actually was nothing related to semiconductors was more related to cameras and instrumentation more like Hewlett-Packard kind of a company. But anyway, they helped start or fund Fairchild Camera and Instrument is what it was called back in the late ’50s, early ’60s. And I joined them in 1963 where they had only been in business for six years. And so there’s Dr. Noyce, Robert Noyce, Gordon Moore, Jay Last, Jean Hoerni, Julius Blank, Andy Grove and who else did I miss?

Peter Marchetti: We have Victor Grinich, Sheldon Roberts.

Ray Zinn: Okay. And then- (more…)

- Jan202021

Silicon Valley History – Part I

Read moreRay Zinn, the longest serving CEO in Silicon Valley, discusses the history of silicon as only he can, having watched it from Shockley to Facebook.

In Part I, Ray and Goldman Sachs analyst Peter Marchetti cover the early days of Silicon Valley and how that led to mass innovation.

Peter Marchetti has spent the past 20 years as an advisor to some of the most significant families and foundations in the country. He joined the Goldman Sachs team in 2000 after receiving his MBA from the Haas School of Business at the University of California, Berkeley.

Ray Zinn: Hello, everyone. Welcome to another fantastic Tough Things First podcast. We’re so delighted to have you with us again today. This is going to be a very, very special series of podcasts that we’re going to do, which is all about the history of Silicon Valley. You’re going to get to hear from start to finish, if you’re interested anyway, about Silicon Valley, you’re going to get a chance to hear about that. It’s great to have a very special guest today, someone who is a good friend of mine who has expressed a lot of interest in the history of Silicon Valley.

It’s because of him that I’ve decided to do this series of a broadcast. Now we’re not sure how many is doing a high out, but my guess is somewhere between five and six will be about the history of Silicon Valley. It’s going to take a bit of time to cover all this. We apologize in advance. If it seems a little bit chopped up as we go through it, because in 60 years, that’s a lot of history. With me today, I have my good friend, Pete Marchetti, who is a financial advisor. Welcome, Pete, to the podcast.

Peter Marchetti: Morning, Ray. Thanks for having me. I’m excited.

Ray Zinn: Well, I’m excited too. Let’s just dive into it. I’m going to give a little bit of a preliminary about this so that people will understand. Silicon Valley really didn’t become the name Silicon Valley until 1969, but it actually started much earlier than that, the whole thing about Silicon Valley, the area, anyway. We call it the Bay Area right now. Just a little bit of a background there. The people that were actually the founders of Silicon Valley as you would, what they call the Traitorous Eight, actually began back at Bell Labs in I think Pennsylvania.

Bell Labs actually started from Alexander Graham Bell who actually invented the telephone. The name Bell Labs comes from his name, Alexander Graham Bell, the inventor of the telephone, which is, again, probably our first electronics that we’ve ever had. Anyway, and so that’s a bit of a start of that that I want to cover, is that the Bell Labs people were the ones that actually got this thing undergoing in Dr. Shockley who left Bell Labs and then took with him the Traitorous Eight and came to the Bay Area, basically, in the area of Palo Alto, Mountain View area. With that, Pete, you’re going to be the guest speaker today. You start firing away with your questions, because you have lots of interesting questions.

Peter Marchetti: Yeah. Well, I appreciate that, Ray. As I said, I’m excited to be here today. We’ve had a lot of conversations over the years about, through your experiences, what Silicon Valley is and how it’s evolved to where it is today. I got to say, I think there’s very few people out there that have not just the experience of having worked in the namesake industry for as long as you did and running companies and being involved in the industry, but then also have the amazing ability to recollect names and anecdotes and just situations.

Through our conversations, I know I’ve learned a lot. I got to say, today, I’m really interested as just another kind of a listener of the podcast, if you will, to hear more of your stories. One of the things that I guess when I think about our discussions that I’ve never really hear you talk about is, you grew up in the Imperial Valley really far Southern California. I think it was a little bit more of a rural area where you grew up. Then you went to school in Utah. Again, not really a metropolitan area, I think, around BYU.

Then you decided to come to Silicon Valley or what was not then yet Silicon Valley. You decided to move to the Bay Area to work in transistors. I guess I am wondering, what led to that? What was the allure at the time for somebody like you, a young engineer who had been from other parts of the country to move here at that time? What drew you? (more…)

- Jan132021

Trey Taylor and the CEO’s Three Things

Read moreRay Zinn, the longest serving CEO in Silicon Valley, sits with Trey Taylor, author of “A CEO Only Does Three Things” for a chat about the priorities facing every business leader.

Ray Zinn: Hello everyone, this is Ray Zinn. I’m the author of Tough Things First. Welcome to another Tough Things First podcast. We really appreciate you joining us and listening to these podcasts. My guest today is Trey Taylor. He is the author of a new book, brand new book, called, A CEO Does Only Three Things. I’m so happy to have you on Trey. Why don’t you give us a little bit of background on your book, and why you wrote the book, and then we’ll take it from there.

Trey Taylor: Yeah, Ray, great. Thanks for having me and good to be with you. I get asked this question a couple of times a week now with the book being on Amazon and doing a lot of media in support of the book. The answer is pretty simple. I heard a speaker one day say that the only moral imperative we have is to be the person we needed when we were younger. I thought, gosh, that’s just a good way to live your life. I really noodled on that for a long time. One of the answers I came up with was that I needed a book on how to be a CEO when I was a young CEO. I set that out as a journey a couple of years ago and wrote the book and present it as a gift to those CEOs who are starting out now. But then as the book has come into its own, I’ve heard from CEOs who’ve had the position for a long time, that there’s wisdom in it for them as well, that concept of finding your focus in the C-suite again. So, it’s had a really good reception in the market, and for that, I’m grateful.

Ray Zinn: It’s interesting, a CEO does lots of things. Your book really focuses on the three things that they really have to do, as opposed to the three things that they do do. It’s interesting that you concentrated on the three things they must do, as opposed to the many things that they do on a daily basis. I’ve been a CEO for 37 years and run my company through many, many downturns and difficult times. I can certainly empathize with your point that there may be lots of things they do, but only three things that they must do. Let’s review those, if you would. Trey I’ll let you start off by talking, what’s the first thing that they must do?

Trey Taylor: Yeah, absolutely. It’s just like you and I were talking previously, every CEO says, oh gosh, I wish I had three things to do and only three things to do. Of course, we understand that, we understand that the task list is always there, the to do list is always there. You have things that you need to assist in, things that you need to touch, that sort of thing. But the three things that we think a CEO should really only do are the three things that the CEO only can do. No one else in the organization can own those things. So, those three things are culture, people and numbers. When we talk about those, we talk about those in terms of the CEO setting the agenda and giving the model for what a successful implementation unique to those three verticals looks like. If we took the first one, it would be culture.

Ray Zinn: Okay, let’s talk a little bit about how important culture is. (more…)

- Dec022020

Tech Nationalism

Read moreTech Nationalism is driving China’s near-term goals. Can the U.S. compete and what do startups need to know about this tech tug-o-war?

Ray Zinn is back with another informative episode of the Tough Things First podcast.

- Nov112020

Supply Chains – The Onshore Option

Read moreAre jobs and manufacturing poised to return to the United States? What will it take?

In this Tough Things First podcast, Ray Zinn discusses the dynamics of offshoring and hurdles to balancing out the benefits other countries offer.

Rob Artigo: Rob Artigo here once again, your guest host for this edition of ‘The Tough Things First’ podcast. I’m a writer, an investigator in California being invited back, always a pleasure, Ray.

Ray Zinn: Well, thanks, Rob. It’s always good to have you on the program with me because you always had these interesting subjects and topics you want to discuss.

Rob Artigo: Thanks, Ray. So I went to Best Buy and Fry’s Electronics in just one day during the pandemic to find a radio and what I found was a lot of empty shelf space and it was actually disconcerting and bothered me because the products that I wanted were not there first of all. But a lot of products that were normally there aren’t there. And I suspect that it couldn’t only be a matter of people over shopping right now, but it was also something that went to the interruption of the supply chain. So even before the pandemic, the president was suggesting the US would pay companies in the supply chain to bring the supply chain back to the continental US. So I’m wondering in your mind, is this a feasible and noble idea for the US to want to bring the supply chain back to our continent?

Ray Zinn: Well, it’s like the stimulus package that 2 trillion or… Whatever, I can’t remember the exact number, but this is a couple of trillion dollars worth of stimulus. And so it’s not unusual for a country, whether it be the US or any other country, to offer a stimulus, to help out in a particular situation. The current stimulus, which of course, was to help families through this shutdown and through the economic recession that we had introduced by the coronavirus.

How does stuff get outsourced? In other words is let’s talk about how does products and technology get outsourced to begin with? It’s very simple. Countries like Ireland and China and Korea and Taiwan, Singapore, India, they all offer stimulus and incentives. They’ll say, okay, if you’ll bring your company or a part of your company to our country, we’ll buy you a building, you’ll pay no taxes. And that’s one of the problems that we’ve had by the way, is that we’ve not taxed companies, US companies that have gone out outsourcing outside. So we’ve not, apparently, not thought that was a bad deal, but like anything else that pendulum swings too far. And as a consequence our country suffers, employment suffers because now we’re outsourcing these jobs in this technology. (more…)

- Oct282020

How to Set SMART Startup Goals at The Idea Stage

Read moreNot all start-up ideas are created equally. In fact, most are doomed to failure.

Are there ways to determine if an idea is worth pursuing before you hit a wall? Ray Zinn, in this Tough Things First podcast, says yes, but it means self-critique and asking the toughest questions in the idea stage.

Rob Artigo: I’m Rob Artigo, your guest host for this edition of Tough Things First. Hi, Ray. It’s good to be back with you.

Ray Zinn: Well, thanks, Rob. I’m glad you were able to join me today.

Rob Artigo: I was reading today about the failure of ambitious bike share programs across China. You’ve probably heard about this, the bike sharing apps out there. We’ve got them in this country too, but in China it was supposed to be a boom because China has been known for bikes for many years. And apparently, the companies across China that had been doing these bike shares are failing.

The story that I was reading says, “Unused bikes are piling up in bicycle graveyards. Cues of angry users are demanding their deposits back.” And it says that, “It’s obvious just how doomed the idea was from the start. The rise and fall of the China bike craze played out like a sped up version of every tech bubble, an unprofitable idea sustained by fantasy, false predictions and the power of bigger firms.”

I don’t want to talk about bikes and I don’t really want to talk about China in this case, but I want to talk about that last part though, “The craze played out like a sped up version of every tech bubble with an unprofitable idea sustained by fantasy, false predictions and the power of bigger firms.” I want to talk about ideas, but first let me get this from you. The shortlist of pitfalls. This one here that I just mentioned should be on anyone’s shortlist of concerns at the idea phase of any startup. Am I right?

Ray Zinn: Right. You start out by saying in the article, it talked about the doomed idea. It should be dumb idea. What dooms us or dumbs us down is the fact that we are so caught up, we’re so enthusiastic about what we’re doing that we don’t sit back and think about the pros and cons.

When you’re starting up a company or you come up with an idea, you got to go through what we call the pros and the cons, pros being the reason why you want to do it, the cons, reasons you he shouldn’t do it. And I think that’s what’s missing is that the cons tend to be overlooked. And the cons should be equal in number as the pros.

In fact, what I liked to see when I was running my company, Micrel Semiconductor, was when people brought in their proposal, which is like an idea, I looked to see how many cons they have. And if they have more cons than they do pros, that excites me. Then I thought, “Oh man, they’re really looking into this.” So I’m actually looking for more reasons why not to do it than to do it, because I know that we’re trying to drink our own Kool-Aid. And as a consequence of that, we tend to overlook the reasons why not to do it. So cons of course, are the reasons not to do a particular idea. (more…)

- Oct142020

Friendly, Not Friends

Read moreEntrepreneurs can either learn this quickly or slowly, but eventually they’ll learn or fail.

Relationships with employees are about being friendly, not being friends.

In this episode of the Tough Things First Podcast, Ray Zinn offers insights and examples to one of the most common workplace management problems.

Rob Artigo: I’m Rob Artigo, your guest host for this edition of the Tough Things First podcast with Ray Zinn, the longest serving CEO in Silicon Valley. Hello again, Ray.

Ray Zinn: Rob, hey. It’s good to be back on the program with you.

Rob Artigo: Sure. Got a good topic for you, but I sometimes watch Food Network and a show called Restaurant: Impossible because being a business guy, I just like to watch how people fix problems with their businesses. And this chef, Robert Irvine, goes around the country and he breathes new life into these restaurants. He redecorates, but also shows them what’s wrong with what they’re doing with their businesses.

As an entrepreneur, particularly a new one, there are lots of management lessons to be had in shows like this. And I saw an episode recently where the owner operator of the restaurant was… She was an extremely nice lady. So probably somewhere around middle-aged. But again, a very gracious, nice lady and meant very well. Some of her employees were her own offspring. So she had a son who was a chef and she had some daughters who were working in the restaurant waitressing and managing the front of the house, as they call it. And one of her major faults, perhaps the major fault and why her business was failing was she handled the employees with kid gloves, like a mom or somebody who’s trying to be the friend of the employee. She even said, “I want to be their friend.”

And so as a result, they walked all over her and she did most of the work herself. I mean, she would do cleaning that a regular employee should be doing, but she would stay late and have to do the cleaning because those people that were supposed to be doing it, didn’t do it and then she didn’t hold them accountable. So what she learned was we want to be friendly with our employees, but not be their friend. I imagine that you, with all of your experience managing people at all levels of business, had to learn that early on in order to get things done, that there was a relationship that you had to establish with people that had boundaries.

Ray Zinn: Well, it’s the same thing with parents. How do you be a child’s friend without looking like their sibling? And that’s what happened in this case that you referred to with this owner, female owner, who was being too friendly [inaudible 00:03:06] not willing to push her people. And so therefore they pushed her. And so how does a parent become a friend of the child without being, or become friendly with the child without being their friend? And that sense of the word of co-equal. That’s the challenge that all business owners have is to be friendly, but not be their friend as you would. And so there’s a difference between being too cozy with someone and then yet being friendly. When I was running my company, I’d make a habit of going around saying hi and visiting with people, but not becoming too close. (more…)

- Sep302020

Creating Enduring Businesses – The Top Three Tough Things To DO

Read moreTo create an enduring business means creating one that will last. That is different than creating a startup and selling it off.

Ray Zinn, Silicon Valley’s longest serving CEO, and one who ran his semiconductor business for 37 years, tells you the top three things you need to do to make your business enduring.

Guy Smith: Hello everybody, and welcome to another special edition of the Tough Things First podcast. This is something we’re doing differently this year, several times a year we’re going to have a special episode where we talk about the top three tough things that you as a business leader need to do for a specific topic. And today we’re going to talk about the tough things first that you need to do to build an enduring business. Now, what do we mean by enduring business? I’m going to cheat here because I took this from Ray Zinn’s book, Tough Things First. And an enduring business is one that is not designed to be a bottle rocket, it’s designed to be a hoist, it’s designed to be steady day in, day out, profitable for this generation, for the next generation, for the generation after that. And that’s what Silicon Valley often avoids doing, is building enduring businesses. So we’re going to talk with Ray Zinn and we’re going to get those top three things to build the enduring business. And on that note, hello Ray, how are you?

Ray Zinn: Doing fine Guy, thanks for this opportunity to meet with you us again, to talk about the top three tough things first that we need to do.

Guy Smith: Well, and I think it’s important for your audience to keep in mind that Ray is literally the longest serving CEO in Silicon Valley. I mean, he is a legend out there, the way that he started his company, the level of employee commitment to his company as demonstrated by the low turnover rate, and the number of people who left the company and then came running back because they discovered it really was a great place to work. All of this fits into today’s topic about the enduring business and Ray’s advice is to how to do that. So let’s jump right into that, Ray. Tell me what the number one aspect of building an enduring business is. What’s the first thing every business leader needs to focus on?

Ray Zinn: Well, I’d like just to go back a minute where you’re talking about what is enduring. Enduring is the opposite of endearing. Enduring, as you pointed out, is like a hoist. It’s sustainable, it doesn’t fizzle out. Endearing is like the 4th of July fireworks, that looks great for about 20 minutes, everything’s all wonderful and you’re all excited, and then it fizzles out. So the endearing companies fizzle out, the enduring companies don’t look glamorous in the sense of word. They can take and sustain great loads for long periods of time. And so to do that, the first thing you got to do is make sure that when you start your business, if you’re a startup, or even if you’re in a company or a business that has been underway for a while, is to make sure you have enough cash to sustain yourself. That you’re not just here today, gone tomorrow, sustain yourself means that you are profitable.

And then that means having enough cash to take you to profitability. And so if you’re say on net 30 days (more…)

- Sep162020

Strategies for Managing Work Stress

Read moreNo matter what phase a company is in, or the level of employee or management, work stress goes with the territory.

In this Tough Things First podcast, Ray Zinn draws on decades of experience to talk about identifying stress and dealing with it before it throws you off your game.

Rob Artigo: Welcome back to another edition of the Tough Things First podcast. I’m your guest host, Rob Artigo. I am a writer and entrepreneur in California. Hi, Ray.

Ray Zinn: Hello there, Rob. So good to be with you this morning.

Rob Artigo: Sure. I hope you’re not too stressed.

Ray Zinn: Well, in these days with all the things that are going on, this pandemic and economic issues and political issues, you just can’t help but be stressed.

Rob Artigo: Yeah, I guess it’s kind of natural. So, that’s where we lead into here. And stress at work, it seems, is about as ubiquitous as stress in life. In particular, like you said, in a situation like this. And I think it comes down to a matter of degree. And most times in our lives, we don’t have as much turmoil as we have now, but it sort of depends on how we respond to it. And so let’s talk about the workplace stress aspect of it and inside and outside of the situation that we’re facing now, but something that we would most likely face going forward is our stress in our workplace. So is workplace stress inevitable?

Ray Zinn: Yes. We talk about stress as though it’s some kind of a medical issue, but stress actually comes from fear and fear is the predecessors to stress. So we’re fearing something and that’s what causes us to be stressed. And so if we can recognize these fears, it’s kind of like climbing a mountain that’s got some really difficult slopes to it. And so as you approach the precipice or whatever it is you’ve got to navigate around, there’s stress. And so if you’ve done it before, in other words, you’ve made that climb many, many times before, then the stress is down because the fear is down. You’re just less fearful.

A friend of mine was doing a serious climb up in the Grand Tetons and he had never done it before. He didn’t eat, he didn’t sleep, he just tossed and turned. He says, “Why am I doing this? Why am I tearing my mind up and my body up just so I can say, ‘I climbed the Grand Tetons.'” We all face at some point a Grand Teton type journey, where if we’ve never done it before, if this is something new and different, there is that potential to not sleep well, to not eat well.

The first thing you have to do is recognize whether or not you are engaged in a stressful situation. You can tell that by, are you agitated? Are you eating well or correctly? Are you sleeping well? And so I think that the first thing to do is just really sit back and just kind of analyze what’s causing my stress. And then if you can kind of understand it, then you can probably reduce the fear factor. You’re not going to get totally rid of it, but you will understand why am I fearful? What is causing this anxiety? (more…)

- Sep022020

Ruthless Consistency

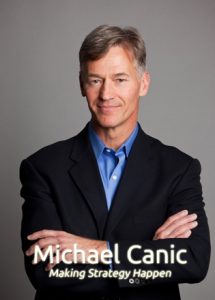

Read moreRay Zinn sits with Michael Canic to discuss Michael’s new book, Rutheless Consistancy and how discipline fits into the business consistency framework.

Ray Zinn: Hello, everyone, and welcome to another very exciting Tough Things First podcast. My name is Ray Zinn. I’m the host for today’s podcast. I’m an author. I’m the one that wrote Tough Things First, as well as the Zen of Zinn, I’m a adjunct professor, a lecturer, Silicon Valley’s longest serving CEO of a public traded company. And I’m very excited to have with me today Michael Canic, who will be our guest speaker. Welcome. Happy to have you today, Michael.

Michael Canic: Great. Great to be here, Ray. Thanks.

Ray Zinn: Yeah. And Michael has just written a very, very exciting new book called Ruthless Consistency. Wow. What a title. And Michael is a coach. He’s been a teacher, and now an author, and also a trainer. I’m just so excited to have you on the program today.

So let’s talk about your new book, Michael, this Ruthless Consistency, as you refer to it. So in your book, you talk about developing the right focus, creating the right environment and also building the right team. So why all three of those?

Michael Canic: Well, what I found in my experience as a consultant and in the corporate world, also as a football coach, as you said, Ray, is that when you look at why organizations fail or succeed, what I found was that every case of failure I looked at and studying why organizations fail, either they hadn’t developed a clear focus, clear and sustained focus, or they didn’t create the right environment for their people to be successful in executing it, or they didn’t have the right team. And every initiative always comes down to those three things. Do we have the right focus, right environment, and right team? When you have all three of those aligned, those are the organizations that can win.

Ray Zinn: Yeah, perfect. I’m a big advocate of consistency. I think of consistency as being something that if you want to talk about being dogged and so forth… Ruthless, though, sounds a little bit ruthless. So how’d you pick the name ruthless as opposed to dogged or persistent?

Michael Canic: Well, just to say consistency, everybody goes, “Yeah, yeah. Be consistent.” But what I wanted to convey with ruthless was this unwavering commitment, this absolute unwavering commitment where everything you say, everything you do, all your decisions, all your actions are absolutely aligned with what your goal is, your intention. So the notion of ruthless really is just that unwavering commitment to being consistent with what your intended outcomes are. (more…)

- Aug262020

Worker Decentralization

Read moreWorld circumstances put more people in a work-from-home situation and companies forced to manage it than ever before.

In this Tough Things First podcast, Ray Zinn explores the trend and its drawbacks.

Rob Artigo: Rob Artigo here, your guest host for another edition of the Tough Things First podcast with Ray Zinn. I’m a writer and entrepreneur being invited back. Always a pleasure, Ray.

Ray Zinn: Rob, it’s all good to have because you have all these great questions you want to discuss.

Rob Artigo: Well, I think this one’s going to be an interesting topic because with all the pandemic and everything, people’s lives have changed a lot. Many people are working from home. I can’t think of a more glaring example of work from home possibilities than what we’ve witnessed during the pandemic. I read an article by a top UBS executive who laid out some moves by the Swiss bank to tackle the future of work, and they’re rethinking their real estate, its footprint out there. They’re also using lessons from the pandemic to accelerate change in all kinds of different ways.

I know that can be a can of worms in many ways because it can go off in so many different directions, but let’s look specifically at businesses, large and small, startups that can be five or six people to companies like Google or Facebook. I know some people working for Facebook who’ve been working from home for months and months on end and not going into their gigantic campus that they have there in the Silicon Valley. So let’s look at that, extreme staffing levels maybe to just a skeleton crew and so many people working from home. Is reducing brick and mortar footprints for big companies or even small companies, worker decentralization, that’s in not having them at a central workplace but having them work from home, is that the wave of the future?

Ray Zinn: Well, it certainly will be. This is kind of getting off the subject a little bit, but I haven’t been able to get in to see a barber since March. So my wife has been cutting my hair, and she’s learned to cut it and she’s doing a good job. So in my case, I won’t be going back to the barber again. I’ll just had my wife cut my hair. So it’s that similar situation, people having to eat at home now are getting out of the habit of going out to eat. I have a son-in-law, my daughter and her husband, go out to eat four times a week, but they haven’t been able to save pandemic. They’re out of the habit of going out to eat, so they’re just learning to eat at home. (more…)

- Aug122020

Greedy CEOs

Read moreSome CEOs are greedy, for their wallets, for market share, for fame.

Silicon Valley’s longest serving CEO has seen them come and go, and now tells you how to watch out for them

Guy Smith: Hello, faithful listeners in the Tough Things First podcast arena. This is Guy Smith. I’m your host today. And as always, we’re having a chat with the longest serving CEO in Silicon Valley, Mr. Ray Zinn. And we’re going to talk about something which I find intriguing, we’re going talk about greedy CEOs and the damage they do to their companies.

We see quite a bit of this in Silicon Valley, CEOs who have jettison ethics and a few other things in order to get those top line revenues up, and to make themselves or their companies look very good in the public eye, only to have them eventually look very bad in the public eye. So we’ll jump into that right away. And hello, Mr. Ray Zinn. How are you today?

Ray Zinn: Doing fine, Guy. Thanks again for being with me on this program.

Guy Smith: Well, these chats I have with you are the best business education I have ever gotten in my life. And that’s saying a bit, because I have a degree in management sciences. And so, drinking from your fire hose is quite a satisfying thing for me.

So, let’s talk about these greedy CEOs. I’m not going to drop names, but anyone who’s been working in Silicon Valley can probably think about half a dozen of these gritty CEO types right off the top of their head. They have this maniacal pursuit for top line growth at all cost. And I think it’s that all costs, which is defining this. So why do CEOs do this? I mean, you ran a company for 37 years. You were profitable all but one year, and that one year was the outlier year at the dot-com implosion.

You never had to chase that top line growth. You were always more worried about the bottom line growth. So why do other CEOs go running mashugana off into the field chasing this top line growth? (more…)

- Jul292020

Toxic Corporate Culture

Read moreHow do toxic corporate cultures arise, and how do you cure them? The Silicon Valley leader with the lowest employee turnover rate tells you.

Guy Smith: Hello, and welcome to another episode of the Tough Things First podcast, where we pick the brain of Silicon Valley’s longest serving CEO, Mr. Ray Zinn. I think today’s going to be an interesting topic, at least for me, because we’re going to talk about toxic corporate cultures. I have been in my share of those in my past. My name is Guy Smith. I’m your host today and with us again as always Mr. Ray Zinn. How are you, sir?

Ray Zinn: Well, we’re doing fine. It’s a beautiful day outside. Yesterday it was kind of funny had a Tom turkey gobbling around my yard, which was a first for me that was kind of interesting to see him wandering around. My wife said, “Oh, early Thanksgiving.”

Guy Smith: Well, when I finally left Silicon Valley and went out to North Carolina, I’ve got turkeys and black bears and all sorts of things roaming around in my front yard, it’s a veritable zoo out there. Let’s talk about the zoo of toxic corporate cultures because boy, those places can seem like a dog eat dog world. What I’m really curious about, more than anything else is what causes a toxic culture to develop? I mean, what are the seeds and how did those seeds grow to the point where an organization is just all about backbiting and all the negative things that make organizations not work well?

Ray Zinn: I’d say in one word, it’s apathy, apathy toward having a corporate culture. Like a stream, it’s going to seek the path of least resistance. When you talk about apathy toward a corporate culture, just letting whatever culture is dominant prevail, and that’s a sad thing. It’s become more of a live and let live kind of mentality or work and let work as you would.

Guy Smith: That’s an interesting contrast, sir, because I’ve studied a little criminology in my past. I know that in certain inner city subcultures, there is a complete apathy towards the community towards your fellow man. I think you’re onto something here. Once that apathy settles in, then it becomes the norm and no one cares enough to try to improve the situation.

Ray Zinn: Well it’s apathy toward obeying the law. Anytime you have apathy toward anything, apathy toward quality apathy toward service, apathy toward allegiance, apathy toward loyalty, apathy toward country, apathy toward anything it’s going to become toxic.

Guy Smith: Well, and that may explain a little bit about our current political conundrum. Where does this apathy normally start from? I mean, does it start from the bottom or does it start from the top or can it start anywhere? (more…)

- Jul152020

Being Best When You Aren’t Feeling It

Read moreIt can sometimes be painfully obvious we’re not physically or mentally up to a task, but what happens when we turn the situation into an opportunity to challenge ourselves?

Ray Zinn tells us in this Tough Things First Podcast that we can learn surprising things about ourselves with the attitude that “the show must go on.”

Rob Artigo: Rob Artigo here. Your guest host for another edition of The Tough Things First podcast with Ray Zinn. I’m a writer and entrepreneur in California. Being invited back always a pleasure. Ray, how you doing?

Ray Zinn: Oh, it’s always enjoyable to do these with you, Rob. Doing great.

Rob Artigo: And I appreciate it too. And I know you have some appreciation for the theater and I know you’ve probably heard the saying, the show must go on. And of course, that’s a reference to a stage acting reference. Basically, the show depends on ticket sales. The audience must get the show that they came for. If the star or the key players can’t perform because of illness or something else, the show loses money and it fails. So then becomes the saying, the show must go on. So we know that life can be that way. And business is often that way. The show must go on. And I’m not saying you work when you got the flu and 102 degree temperature or something like that. You stay home and take care of your health, that’s good.

And hopefully you have a plan for having people pick up the Slack when you’re not around, but I’m talking about, when you are at work, when you are available to do the job, how do you perform at your best when you aren’t feeling your best? I mean, when you feel wrecked and tired and you still have to put up the the performance in the work, the standards that you live by. They say, “I feel like a million bucks.” Let’s say you feel like 52.95 and you have to perform like a million bucks. How do we do that in the work environment?

Ray Zinn: Well, it goes to the saying also, when the going gets tough, the tough get going. And so I know you’re not referring only to the people with 102 degree temperature that are still performing their particular show because there are people who do that. I mean, you hear about this all the time that somebody who had pneumonia or somebody who had some terrific illness or cancer. Look at Rush Limbaugh. I mean, he’s continued to do his daily podcast. (more…)

- Jul012020

Pitching Your Company – The Top Three Tough Things

Read moreSilicon Valley’s longest serving CEO talks about the three tough things to do when pitching your company.

If you don’t do these, don’t bother the investors.

Guy Smith: Hello everybody and welcome to another episode of the Tough Things First podcast. And this is one of our specials. We’re doing this periodically. We are talking with Ray Zinn, the longest serving CEO in Silicon Valley. And we’re getting from him the top three tough things that a business leader needs to consider for a particular business episode that they’re facing. And what we’re going to do today is going to be so choice for the people in Silicon Valley, all the founders, all the co-founders, all the startup aficionados. It’s the tough top three things to consider when you’re pitching your company. And I was in Silicon Valley for over 22 years, I’ve been on both sides of the table pitching and hearing pitches and I’ve got to tell you, after all this time, a lot of people in Silicon Valley still don’t get it right. I have personally turned down, probably I’m going to say about 75 different presentations simply because the people weren’t even prepared to give a presentation, which of course gave me no faith that they could run a company.

So first let’s welcome on Ray Zinn. Hello Ray, how art thou?

Ray Zinn: We art very good, Guy, thank you. It’s a beautiful day here and I’m just glad to be with you.

Guy Smith: Oh, I’m always glad to be with you. It’s educational in ways that I can not begin to explain. So let’s jump into this pitching your company, which is kind of like a national pastime in Silicon Valley and expanding nationally as we begin to see how entrepreneurial centers are kind of erupting in various places around the country. So what are the top three tough things that a founder needs to consider when they’re pitching their company?

Ray Zinn: Well, the message should be very clear. In other words, if you can’t get your message across within the first minute or two, you’re probably going to lose your audience. And so that’s one of the first thing is to have that mission statement so clear and so precise that they immediately understand what it is that you’re doing and when and where you’re headed. (more…)

- Jun242020

Corporate Culture, Part 3 – in conversation with Professor Jennifer Chatman

Read moreThird and final part of a series where Silicon Valley’s longest serving CEO chats with Professor Jennifer Chatman, a Distinguished Professor of Management and the Associate Dean for Learning Strategies at the Haas School of Business at UC Berkeley.

Professor Chatman is also the Director of the Berkeley Culture Initiative, a program with the goal of identifying the most promising opportunities and challenges facing leaders who harness organizational culture as a strategic resource.

Guy Smith: Welcome to the third and final episode in this three part series of the Tough Things First podcast, where with the help of an expert and the experience of Silicon Valley’s longest serving CEO, we are exploring the topic of corporate culture, what it is, how you shape it, how it facilitates innovation, performance, and everything else that’s necessary for your company. Now, if you did not absorb the first two installments of this series, you might want to give them a listen first. We cover how leaders shape culture, how and why it affects innovation. And in Silicon Valley, innovation is everything. So today we’re going to wrap up the discussion and we’re going to talk about challenge and performance.

Now for this series, we’re joined by Professor Jennifer Chatman, distinguished professor of management and the Associate Dean for learning strategies at the Haas School of Business at UC Berkeley. Professor Chatman is also the Director of the Berkeley Culture Initiative, a program with the distinct goal of identifying the most promising opportunities and challenges facing leaders who harness organizational culture as a strategic resource. So, welcome Professor Chatman, and thank you for joining with us for these three episodes.

Professor Chatman: It’s great to be back again, Guy.

Guy Smith: Wonderful. And as always, Ray Zinn, Silicon Valley’s longest serving CEO and a fellow who knows a heck of a lot himself about positive corporate cultures. Hello, Ray.

Ray Zinn: Hi, Guy. Thank you for helping us put this series together. And again, express a deep appreciation to Dr. Chatman for her willingness to help us with this important series.

Guy Smith: We’re going to start this one just a little bit different. Really, I’m going to pitch a question to Ray because I suspect you have faced more than a few culture change moments in the 37 years that you led Micrel’s semiconductor. So tell us a little bit of your perspective about leading an organization culture change. And then if you will, professor, discuss why changing culture can increase team and organizational performance. So Ray, what kind of organizational culture changes did you have to work your way through?

Ray Zinn: Well, life is a learning process. I mean, when we stop learning, we actually die. So, I just learned in my previous job before starting Micrel, I learned by being an employee at these various other companies, what seemed to work and what didn’t work. I’m a student. I’ve always been a student my whole life. Even though I got a master’s degree in business, I still felt I had more to learn. And so I really studied all these different companies and what seems to work and what didn’t work. Even if I didn’t work for them, I would look at them. For example, Jack Welch at GE. I Looked at what he was doing, what worked for him.

And so I really, really am a student of what works and what doesn’t work. And I try to take the best of these different companies and what worked for them and tried to incorporate them, or not tried, I did incorporate them at Micrel, the company that I founded and ran for 37 years. So was that book, Good, Better, Better, or Good, Better, Best, or whatever it is. And so I just wanted to make Micrel the best that there is in the world as far as a company. And that means I had to have the best or the very best culture. So, I learned because I worked at different companies for a number of years what worked and what I thought didn’t work. So that’s how I got started on Micrel. And then I just kept perfecting it and working until I got to the point where I thought that we could be a very efficient and productive company. In fact, Micrel was considered to be the biggest little company in the world.

Guy Smith: So professor, talk to us a little bit about changing culture and how this relates to increasing team and organizational performance.

Professor Chatman: Well, sure. So in the first two podcasts, we talked about the three criteria for developing an effective culture. The culture needs to be strategically relevant, strong, and adaptive over time. And so if you look at your organization and recognize there are some gaps between where you’d like to be in terms of those three criteria and where your organization actually is, well, that means you have a change project on your hands. And so we talk about there being four levers for changing a culture when you have gaps. And the four levers are pretty straightforward, and these are good places to start to look for ways of making your culture more effective, leveraging your culture for strategic success. So let me just talk through briefly what each of the four is. (more…)

- Jun172020

Corporate Culture, Part 2 – in conversation with Professor Jennifer Chatman

Read morePart two of three in a series where Silicon Valley’s longest serving CEO chats with Professor Jennifer Chatman, a Distinguished Professor of Management and the Associate Dean for Learning Strategies at the Haas School of Business at UC Berkeley.

Professor Chatman is also the Director of the Berkeley Culture Initiative, a program with the goal of identifying the most promising opportunities and challenges facing leaders who harness organizational culture as a strategic resource.

Guy Smith: Welcome to the second in a three part series of the Tough Things First podcast, where we, with the help of an imported expert and the experience of Silicon Valley’s longest serving CEO, are going to explore the topic of corporate culture, what it is, how you shape it, how it facilitates innovation and performance, and quite a bit more. Now if you did not listen to the first installment of this three part series, you might want to give it a listen first. Not essential, but it does lay some ground work and helps us more deeply investigate what corporate culture is and why it is so vitally important.

For this series, we’re joined by Professor Jennifer Chapman, distinguished professor of management and the Associate Dean for learning strategies at the Haas School of Business at UC Berkeley. Professor Chapman is also the director of the Berkeley Culture Initiative, a program with the distinct goal of identifying the most promising opportunities and the biggest challenges facing leaders who harness organizational culture as a strategic resource. So welcome Professor Chapman, and thank you once again for being with us.

Professor Chatman: Thanks Guy. I’m glad to be back.

Guy Smith: We’re glad to have you back too.

Ray Zinn: I’m glad to have her back too, Guy.

Guy Smith: And that was Ray Zinn, the longest serving CEO in Silicon Valley and a man who’s no stranger to shaping corporate culture himself. Hello Ray, always good to be with you.

Ray Zinn: So glad to be here Guy, with such a rockstar like Professor Chapman. So I really appreciate her coming back on and I’m very anxious to do this particular podcast.

Guy Smith: Well let’s get on with it. Now in episode one, Ray and Professor Chapman discussed how leaders can create or craft a strategically aligned execution based culture. So today, they’re going to discuss the adaptability advantage and how business leaders can cultivate a culture of innovation. Now Ray’s company, Micrel, was highly innovative. Ray himself holds numerous patents, but first professor, let’s start with you. Draw Ray into a discussion about why culture impacts innovation and how a leader makes that particular combination happen? (more…)

- Jun102020

Corporate Culture, Part 1 – in conversation with Professor Jennifer Chatman

Read morePart one for three in a series where Silicon Valley’s longest serving CEO chats with Professor Jennifer Chatman, a Distinguished Professor of Management and the Associate Dean for Learning Strategies at the Haas School of Business at UC Berkeley.

Professor Chatman is also the Director of the Berkeley Culture Initiative, a program with the goal of identifying the most promising opportunities and challenges facing leaders who harness organizational culture as a strategic resource.

Guy Smith: Hello again, and welcome to another episode of the Tough Things First podcast and this is the first of a very, very special three-part series of Tough Things First where with the help of a particular expert and the experience of Silicon Valley’s longest serving CEO, we’re going to explore the topic of corporate culture; what it is, how you shape it, how it facilitates innovation performance, and quite a bit more. For this three-part series, we’re joined by professor Jennifer Chapman, distinguished professor of management and the associate dean for learning strategies at the Haas School of Business at UC Berkeley in California. Professor Chapman is also the director of the Berkeley Culture Initiative, sorry about that, a program that has the distinct goal of identifying the most promising opportunities and the biggest challenges facing leaders who harness organizational culture as a strategic resource.

Now, Professor Chapman’s CV goes on for quite literally 27 pages. Just her list of publications alone, take up five pages, so rather than recite more of that, let’s instead get started with today’s podcast. First off, welcome, Professor Chapman. Thank you so much for being here today.

Professor Chatman: Thanks, Guy. Nice to be here.

Guy Smith: Of course, on the other side, we have Silicon Valley’s longest serving CEO, a man who is no stranger to shaping positive corporate cultures himself, Mr. Ray Zinn. Hello again, Ray.

Ray Zinn: Hello, Guy and hello, Jenny. So happy to be with both of you.

Guy Smith: I think this is going to be an exceptional three-part series of podcast. I’m going to step back and let the big brains have a discussion about today’s topic, but to go ahead and get started, we’re going to put the question on the table, the question we’re exploring today. Professor, let’s start off with you. How can leaders create a strategically aligned, execution-based culture in their teams or perhaps in their entire organizations?

Professor Chatman: Well, that’s a great question, Guy. Let me start by putting together an argument for why it’s so important to pay attention to culture and then we can talk about to do it. The basic idea here is that no matter what you do or don’t do as a leader, a culture will form. That’s not the question. The question is whether the culture that forms is one that helps you execute on your strategic objectives or worst case scenario, a culture that actually precludes you from achieving your strategic objectives. It’s really not a question of how to create a culture. It’s really a question of how to shape the culture that has developed in your organization and how to ensure that that culture is actually aligned with your strategic priorities. That’s the first piece. (more…)

- Jun032020

Make Points, Not Enemies

Read moreUnskilled communicators can create a breakdown in conversation at every turn, sometimes making enemies in the process.

In this Tough Things First Podcast, Ray Zinn explains how to avoid pitfalls we often create for ourselves using the wealth of knowledge he learned over decades at the highest levels of the tech industry.

Rob Artigo: Rob Artigo here once again, your guest host for this edition of The Tough Things First Podcast. I’m a writer and an investigator in California. Being invited back, always a pleasure, Ray, how you doing?

Ray Zinn: I’m doing great, Rob. So good to be back with you again.

Rob Artigo: Well, it’s happened to most of us at one time or another. It can be at a board meeting. It could be in a design strategy session. It can be just a discussion in passing about where to put cubicles in an office building. That conversation turns into controversy simply because a point we’re trying to get across feels like, to the other person, at least, that it’s a personal attack and maybe you could even make an enemy out of that person. We know that communication is a two-way street, but how do we make a point with someone large or small in the course of the conversation without putting somebody on such a defense that we end up making an enemy out of that person and they shut us off and they don’t want to listen to what we have to say?

Ray Zinn: That’s a challenge of making your point without making an enemy. It depends upon how we sharpen our point. If you sit there, making this as an example, you’re whittling on a stick and you keep sharpening that point and you keep pointing at somebody, they’re going to think they’re your enemy or they’re become your enemy. So, don’t keep sharpening your point. That’s one of the things that you need to do when you’re making your point so that you don’t create an enemy is don’t sharpen it. Don’t make it personal. Don’t make it emphatic. Don’t make it so that it comes across as being you’re harming them because then they will become your enemy. So the challenge is to how to make your point without sharpening it. (more…)

- May202020

Setting Business Goals

Read moreIf Tough Things First stands for one thing, it’s setting and achieving goals even when they are difficult.

In this edition of the Tough Things First Podcast, Ray Zinn talks about setting priorities to meet those goals.

Rob Artigo: I’m Rob Artigo, your guest host for this edition of the Tough Things First Podcast. Hi, Ray. It’s good to be back with you.

Ray Zinn: Rob, it’s so good to hear your voice again. Thank you.

Rob Artigo: And it seems like it’s been a long time, but time marches on and here we are doing another podcast and I’m grateful for that. Now, whether they plan to, or not, like me, most people set some kind of goals every single day. Now that could be something easy, like going to the store, just doing the dishes, maybe doing the dishes isn’t always that easy for everyone, but they’re goals nonetheless. And we got to think of things in terms of this podcast for entrepreneurs and business operators, entrepreneurs do the same kind of goal setting, those small tasks that they have to do every day, because they’re just things that everybody has to do. But they also have to keep the future in mind, their business, where they are, where they’re going, and what’s next.

So, let’s talk about setting goals first, and then we’ll talk a little bit about some of the strategies for making sure that those goals come to fruition. So for you, it’s always been important to set goals when operating your business.

Ray Zinn: Well, even running your life. I mean, it doesn’t have to be running a business. I mean, setting goals is really avoiding procrastination and that’s the title of my first book, Tough Things First. We tend to not want to set goals, for one thing, because it’s a lot of work and because we’re not really willing to do the tough things first. And so, when I wrote the book and we hadn’t yet come up with a title for it, I had my staff together and we were talking about what should we title this book? Vona my VP, she just said, Tough Things First. Do the tough things first.

And so, the only reason we have a goal is to get us to look up, to aim higher, to reach out and to lengthen our stride to be more purposeful in what we’re doing. We don’t have to set goals for things that are almost secondary, like eat once or twice a day or three times a day, or whatever, or go and get the mail. I mean, setting goals is really trying to reach up. In other words, trying to get us to go above and beyond where we are, not just to repeat something we did the prior day to better ourselves. And so, that’s a whole concept of setting goals. (more…)

- May062020

Managing Conflicts

Read moreIn business and in life there are conflicts. Some of those are internal but threaten the external when we lose control.

In this Tough Things First podcast, Ray Zinn explores how entrepreneurs can find a path to being open minded with conflicting with our core principals.

Rob Artigo: Welcome back to another edition of The Tough Things First podcast. I’m your guest host, Rob Artigo. I’m a writer and entrepreneur in California. Hi, Ray.

Ray Zinn: Hi, Rob. So good to be with you again. It’s been a while.

Rob Artigo: Good to be back, of course. Core principles define us and we don’t typically, like we’re doing a podcast here, we don’t just broadcast our core principles to everyone, but if they’re really true principles, at least in my eyes, they’ll manifest themselves in many ways that other people, that everyone will see. I mean, even if we’re not telling them what our core principles are, people will notice what they are even if they can’t define them right away.

Ray Zinn: Exactly.

Rob Artigo: But we’re also asked to be open-minded. Ray, in your experience, are there times when being open-minded is actually challenged by conflicts with our core principles?

Ray Zinn: Well, certainly. If you have a principle that you hold dear to your heart, then someone wants to bring a counter to that or maybe argue with you about that, debate you on that subject, you can get your, as they say your dander up, your hackles up, and then of course as soon as you do that, you shut your ears off. You no longer are going to be listening because you’re in a defend mode. The key is how do you maintain these very solid core principles, and even when they know that you have these core principles, and yet they’re going to want to argue and put you in a defensive mode. There’s a saying that goes, the best defense is a good offense. What you want to do of course is to make sure you don’t get into a defensive mode, because as sure as you do, you’re going to shut your mind off. (more…)

- Apr222020

Bad Decisions, Good Outcomes

Read moreEntrepreneurs are bound to make bad decisions, but it’s how they handle them that is the difference between success and failure. Ray Zinn has seen it all and in this Tough Things First podcast he explains how successful business operators process bad decisions differently.

Rob Artigo: I’m Rob Artigo, your guest host for this edition of the Tough Things First podcast. Hi Ray, it’s going to be back with you.

Ray Zinn: Well, thanks Rob. I appreciate you joining us again today.

Rob Artigo: I’ve got another question about decisions. We talk about decisions on the show frequently and I want to talk about bad decisions. Entrepreneurs make decisions all the time. They make decisions daily and they’re big, sometimes very easy decisions. And sometimes they’re small, very hard decisions. And some are just based on analysis and projections or educated guesses. So no matter how much though that goes into it, some decisions are not going to turn out the way you expect. How does a successful entrepreneur deal with bad decisions?

Ray Zinn: Okay, well let’s first of all talk about a bad decision. They’re always going to be with us. We’re not perfect as human beings. We don’t have privy information. Decisions we make, if the statistics bear out correctly, they’re only good 50% of the time. It’s like flipping a coin.

So what is different about a bad decision is that it’s a decision that’s not corrected. So, that’s the bad decision. And so, I want to make sure the listeners understand what a bad decision is. It’s an uncorrected decision is a bad decision. I make mistakes every day, and so you could say, well that was a bad decision, but then I correct it. And so, a bad decision is not bad if you correct it. As they say, no harm, no foul. So if you make a wrong decision and you immediately correct it or to the extent you can immediately correct it, then it’s not really a bad decision. Does that make sense? (more…)

- Apr082020

Managing Debt and Corporate Growth

Read moreWhen should a company take on debt to enable growth? Silicon Valley’s longest serving CEO has some answers.

Guy Smith: Hello everyone out in podcast land, welcome again to another episode of the Tough Things First podcast. I’m your guest host today, Guy Smith. And as always, we’re having a little sit down chat with Silicon Valley’s longest serving CEO, Mr. Ray Zinn. How are you today, Ray?

Ray Zinn: Trying to stay dry, Guy. How are you doing?

Guy Smith: Well, it’s warming up nicely out here, and boy I am aching for spring, that’s for sure.

What I want to talk about today, a subject dear to my heart, managing debt and managing growth. Founders in startups face an interesting inflection point during their growth cycle. It’s real tempting to go out and score some debt in order to try to rise up to the next level of growth, certain investments that need to be made around the company.

When should a startup consider debt, when should they just flat out avoid it?

Ray Zinn: Debt never sleeps, it’s going to be there 24/7. When you go after debt is a mater of what your growth needs are, if your trajectory exceeds what your cashflow is. Because often, you can grow through cashflow, if you’re profitable, and that’s the way I prefer to do it is to be profitable, and grow through profitability. But, if you’re growing faster than you can grow through cashflow, then debt is fine, presuming that you can fund the debt.

In other words, debt is something that has to be paid every period, whatever that period that your lender sets or you agree to, so that’s the key. The key is make sure that whatever debt you take on, that you can make those regular payments on that debt. (more…)

- Mar252020

Surviving a Downturn – Three Tough Things series

Read moreWhat should a business leader, especially a startup CEO, do to survive a downturn.

Ray Zinn, the longest serving CEO in Silicon Valley, has survived many of them and shares his knowledge in this first in our “Three Tough Things You Need To Do” series.

Guy Smith: Hello everyone and welcome to another episode of the Tough Things First podcast and this is a special event today. This is the first in a series of periodic podcasts that we’re going to do on the three tough things that you need to do in order to have a healthy business. We’re going to pick a different topic every time, but we’re going to pick on Ray Zinn’s wisdom on really the critical elements that an entrepreneur or a business leader needs to face, needs to stare down, needs to take control of in order to make sure that they will succeed in business. Before we go, jumping into the topic today, which is the three tough things that you need to do to help your business survive in a downturn, we’ll bring on Ray Zinn. Hello Ray, how are you today?

Ray Zinn: Doing great, Guy. Thanks for doing this podcast with me.

Guy Smith: Oh, I love doing these podcasts. I learned so much from you per unit time that it’s like drinking from a fire hose. I feel like I’m getting one of the best educations in my life whenever I do a podcast with you.

Ray Zinn: Well, thank you.

Guy Smith: So let’s dive in because right now when we’re recording this, it’s early 2020. There’s no recession probably going to happen this year, but maybe next year. That means there’s going to be an economic downturn and there’s probably a lot of entrepreneurs in your audience who are already kind of anticipating that, but they may not be sure about what to do in a big downturn. So why don’t we start off. Why don’t you give me the first thing that a business leader needs to do in order to be prepared? The one tough thing that maybe they don’t want to do but they got to do in order to make sure that they survive a downturn.

Ray Zinn: Well, there’s two issues that we need to back up a bit here, Guy, because there’s two kinds of downturns. One, a downturn is a reduction in revenue and so it could happen as a startup. In other words, you could not have any revenue and that’s a downturn in that sense of the word, because all startups start at the bottom as they say, or you could be having an ongoing running business and then you hit some kind of snag and the business falls off and then how do you deal with that? So there’s two kinds of, as I say, two kinds of downturns and both are important. Yesterday, I met with a couple of guys who, or actually three guys, who were a nine-year old startup. So can you imagine how you call yourself a startup after nine years? But they’d already gone through $16 million and had no revenue.

So they were talking to me about what I like to invest in their business and I said, “No.” They said, “Well, why not?” I said, “Are you kidding me?” You’ve been at this for nine years and you still are … no revenue. That is a serious issue, I think, for a startup is not to have some kind of recovery plan or at least a, “How do I stop the bleeding?” I learned that they had nine people in their company, if you want to call it a company, and they were all drawing $110,000 a year. (more…)

- Mar112020

Social Causes and Smart Business

Read moreStories and charitable causes are a dime a dozen in the modern start-up era. What is the right balance to market a business while being civic minded? In this edition of the Tough Things First Podcast, Ray Zinn discusses the purpose of social causes and image building in business.

Rob Artigo: Rob Artigo here, your guest host for another edition of the Tough Things First podcast with Ray Zinn. I’m a writer and entrepreneur in California. Being invited back is always a pleasure, Ray. Thanks again.

Ray Zinn: Hey Rob, it’s always good to have you on the program, so thanks again for joining us.

Rob Artigo: You’re welcome. We hear a lot these days about uniting the startup with a story. I know that Marcus Lemonis is on CNBC’s The Profit, he comes to mind because I’ve heard him talk to people about when they’re laying out their displays or their concepts for their stores to have some kind of story that they’re trying to tell, and that can be the story of the single mom who invented a mop or something and a certain kind of special mopping device, or being able to get that story built into the concept of the company, and then also … A lot of entrepreneurs are coming out and saying, not only are we a good company and we’re aware of what’s going on in the world, but we’re also charitable and we’re good people. So every time you buy our product, we’ll donate some money to … I think one was for every pair of eyeglasses they sell, they’ll give a pair to a kid who needs them in a poor part of Africa or something. Or, for example, if you buy our water, you’ll contribute some of the proceeds to a system for cleaning up the plastics in the ocean or something.

These are ideas, I think that a lot of young people are going into business going, “Well I have to show that I’m being charitable so I have to do that.” I’m not sure if it’s a matter of them sincerely feeling like they want to do the right thing, but feel like they have to do the right thing, but you understand what I’m saying here. Is this a good way, a good approach with the business is it is something that you need to do? Both the story and the charity?

Ray Zinn: It’s all part of building your brand. The brand is something you recognize. It’s like Levi with that picture of two horse teams or mule teams pulling on each side of the pair of jeans showing how tough they are. Ford talks about Ford being Ford tough, and so you’re trying to build a brand. Hewlett Packard, their brand was built around doing it the HP way, quality, reliability and so forth. So every company in order to enhance their brand has to have some story. In other words, how do we tell … Because people remember stories. They don’t necessarily maybe remember a brand, but they remember a story, whether it be like air … Forgot now the – (more…)

- Feb262020

Dictator Leadership

Read moreSometimes you choose a management style and sometimes it chooses you. In this edition of the Tough Things First Podcast, Ray Zinn explains the difference in extremes and how to be the best manager you can be.

Rob Artigo: Rob Artigo here once again, your guest host for this edition of the Tough Things First podcast. I’m a writer and investigator in California. Being invited back is always a pleasure Ray.

Ray Zinn: Well, always good to have you on the program, Rob. Thank you for joining us.

Rob Artigo: Ray, I have a copy here of a column that you recently wrote and it’s Alpha Beta Blended Leadership. It’s a really good article. I suggest people go out there and track it down. Ray, you know, it’s about the difference between leadership styles.

Rob Artigo: It made me think about in the military we used to say hey, this is not a democracy, this is a dictatorship. Just go do what I said, you know. We’re not taking a vote on this. Now there are two different styles there, and your article, it really says that they’re not mutually exclusive. It’s part dictatorship and it’s part democracy.

Ray Zinn: Right. You know it’s interesting that we get labeled, so this concept of this Class A personality or Class B or Super A or whatever, those are labels, and people tend to put these labels on us. So if you are in a leadership capacity in a company you’re probably going to get labeled as a Class A personality generally speaking, or a Super A or whatever, and that’s what we refer to as the alpha personality person who has to always have their way.

In leadership you tend to get saddled with that, because what happens is is that leader or the CEO, vice-president, whatever, they’re the ones making all the decisions, and if you don’t agree… As a subordinate you don’t agree with that decision, you tend to think of that person as being an alpha, or being a Super A personality, in other words always have my way or the highway kind of thing. (more…)

- Feb122020

Decide Differently

Read moreEntrepreneurs make decisions all day, but do successful entrepreneurs make decisions differently? In this Tough Things First podcast, Ray Zinn explores the process of effective decision making.

Rob Artigo: Welcome back to another edition of the Tough Things first podcast on your guest host, Rob Artigo, writer and entrepreneur in California. Hi, Ray.

Ray Zinn: Hello Rob.

Rob Artigo: Well, you know Ray, there’s really not a single person on this planet who doesn’t make decisions daily, but an entrepreneur makes multi-tiered and often complex decisions almost as frequently. So thinking about small decisions and big decisions, do successful entrepreneurs make decisions differently?

Ray Zinn: Absolutely. So what entrepreneurs can do is, because they are thinking outside the box and are listening to their gut as well as their head, they can make a decision with a lot less information than say a regular person because it’s called process by analysis. The ordinary person who is not entrepreneur tends to overanalyze something because they’re afraid to make a mistake. And as you know, entrepreneurs don’t worry about mistakes, they just move forward. And in fact, people who are good actors, when they make a mistake, it doesn’t show because they just keep going along and you never hear the mistake. I was talking to a professional organist and he said, “Did you notice the mistake I made?” I said, “No, I didn’t.” He says, “Good.” So he was able just to cover it up.